Financial Services

Enhance Security, Privacy and Compliance While Maintaining Availability

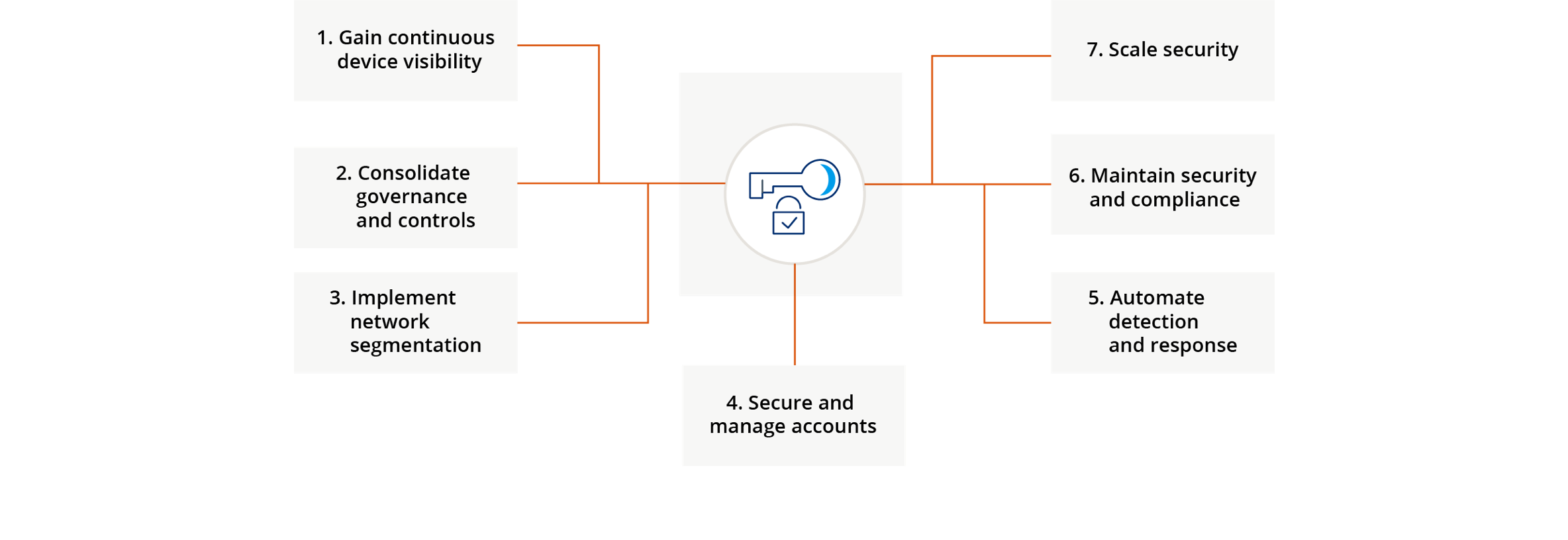

Financial services and banking organization have complex networks that house business-critical data and applications in physical, virtual and cloud environments, creating blind spots and cybersecurity concerns. Gain zero trust security with 100% device visibility and control, network segmentation and unified policy enforcement.